I believe all of us have done financial planning or sort of budgeting. A simple way of computing our transportation allowance going to work or school can be considered as budgeting. Unfortunately, many of us do not apply budgeting techniques in our daily lives and that is why we end in debts and over-spending.

|

| Bullet Journal for Budget Planning |

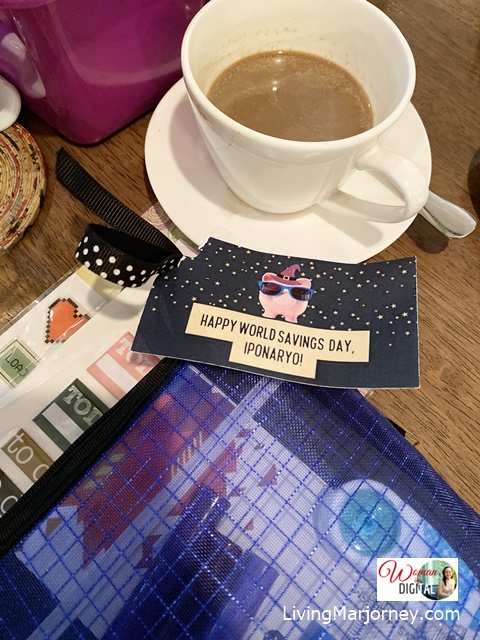

Recently, I attended an intimate talk hosted by Cebuana Lhuillier. The discussion focused on how effectively you can save money and achieve your financial goals. It also coincides with World Savings Day, an annual celebration that highlights the necessity of saving for the future and addressing the financial literacy gap.

|

| Ms. Lani of Cebuana Lhuillier shares benefits of creating a bullet journal |

|

| Ms. Natalie from Cebuana Lhuillier |

Speaker, Izza Glino of Savings Pinay shared insights and tips on saving. She started with RESET, which means to adjust, fix or do something better every time we fail. When was the last time you felt like needing a reset button in your life? Izza listed 7 steps:

|

| Izza Glino of Savings Pinay |

1. Understand your current financial situation

2. Review spending habits

3. Make small changes

4. Budget

5. Set new or better saving goals

6. Put your plan into action

7. Correct and adjust

In budgeting, it is important to first understand your current financial situation, from there you can create a SMART goal. We need to review our spending habits so that we can make adjustments. By doing this, we will identify where our money usually goes. Is it small or big spending bad habits that hinder us to save? Once we've identified these, we can start making changes but it's better to start small. For example, instead of spending much on milk tea, why not try making one at home. Not only that you save, you can even make a healthier one because you know the ingredients you use.

|

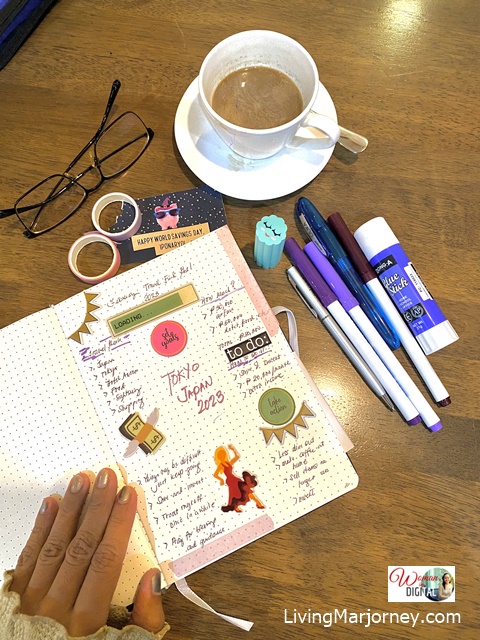

| My Vision Board Journal |

Once you're ready to put your hard-earned money to budget, you may start allocating funds for all your expenses (bills, food, medical expenses like medicine, etc). I recommend having a notebook where you can write it down. Check and balance your income versus expenses and if possible do not spend more than what you earn.

During the event, we were asked to create a journal. Since I'm planning to go out of the country next year, I have to create a SMART goal to achieve my financial goal.

Cebuana Lhuillier's Micro Savings

Last but not the least, I highly recommend opening a savings account especially if you have problems with self-control and have the tendency to overspend. Cebuana Lhuillier's Micro Savings aims to provide easier banking especially to ordinary Filipinos. It is a regular savings account but doesn’t require maintaining balance. Account holders can deposit and withdraw anywhere at their most convenient time with Cebuana Lhuillier’s network of more than 2,500 branches nationwide. As a Micro Savings account holder, you can also pay cashless using your card in any of 350,000 Unionpay and Bancnet accredited retail stores and withdraw in any of 21,000+ Bancnet ATM nationwide.

|

| Cebuana Micro Savings |

How to open a Micro Savings account?

Go to any of Cebuana Lhuillier’s 2,500 branches nationwide and fill-out the Client Customer Information File Sheet and bring the following:

> 1 Government issued ID

> Birth Certificate (applicable to minors only)

> Student ID (applicable only if student is currently enrolled)

> P50 minimum initial deposit

> P150 card fee (for clients w/o 24k card), P75 for card upgrade

More photos...

0 comments:

Post a Comment

Share your comments and reaction.